Our Services

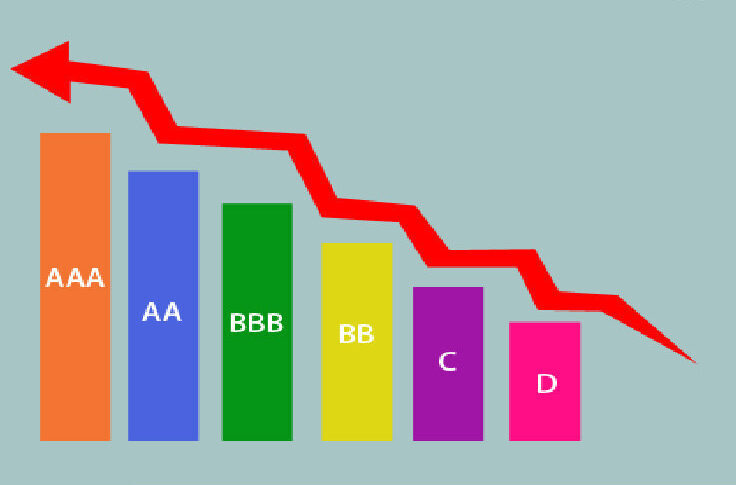

Credwise Team’s expertise and experience in rating industry makes us the strongest player in credit rating advisory among the industry. Credit rating advisory services are designed to be comprehensive and flexible, addressing the unique requirements of each client and guide them through the credit rating process, offering insights, strategies, and solutions to enhance their credit standing. The primary goal is to help businesses secure favourable credit terms, maintain financial health, and mitigate risks associated with credit transactions.

Shadow ratings provide an alternative perspective, often incorporating additional factors, industry-specific insights, and nuanced assessments. Credwise is a prominent name for shadow rating advisory services. A shadow rating model is an internal rating approach that selects and weighs the risk drivers to be used for risk differentiation purposes by identifying the main factors that explain external ratings provided by an external credit assessment institution or similar organisation, rather than internal directly observed defaults.

Resolution plans are comprehensive strategies developed by companies to navigate and recover from distress or failure while minimizing the impact on the broader financial system. It is a rehabilitation plan for a corporate debtor that is going into insolvency. Credwise offers independent assessments and guidance to enhance the quality and effectiveness of these plans. Credwise helps in developing an effective Resolution Plan based on the information memorandum provided by the Resolution Professional that focuses on legal, financial, management, and technical methods.

Credwise advisors can be incredibly helpful in navigating the fund raising process. With their extensive market knowledge, the Credwise team can offer insightful advice on valuation and deal structure. They can also help with due diligence, offer advice on deal conditions, and make sure the process continues as planned.

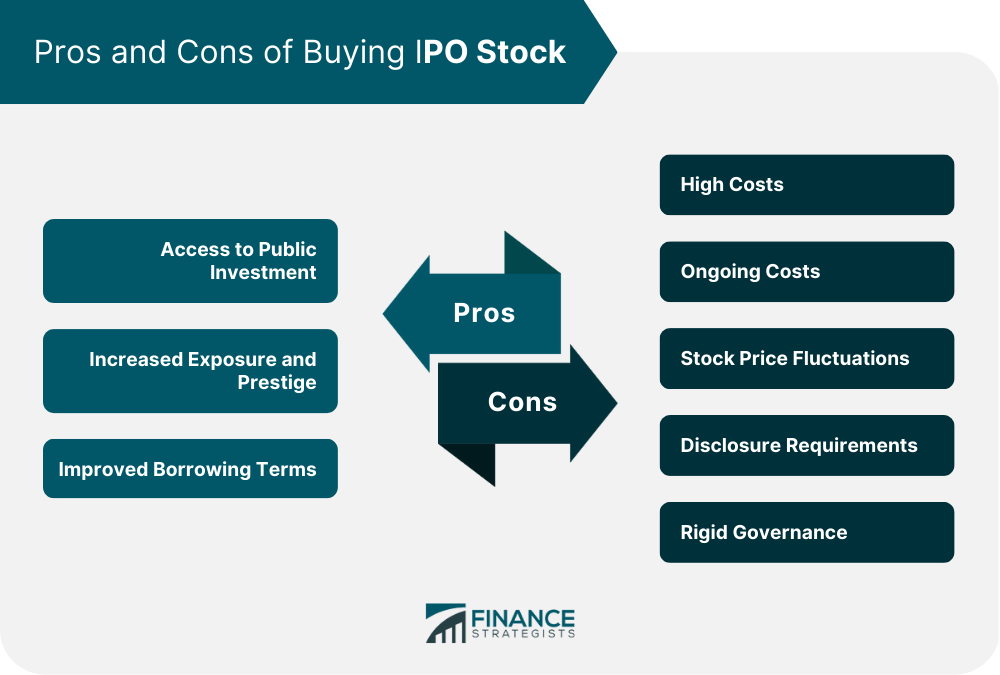

Our IPO/FPO Advisory Services play a pivotal role in guiding organizations through the intricate process of going public on major stock exchanges. Credwise’s offerings encompass a range of strategic and operational support provided to companies across sectors intending to list on prominent stock exchanges, such as the Bombay Stock Exchange (BSE) or National Stock Exchange (NSE). Credwise’s objective is to assist companies in navigating the complexities of the IPO process, from pre-listing preparations to post-listing compliance.

With in-depth knowledge of the whole equity markets fund raising process including – identification, initiation, structuring, valuation and execution, Credwise team can assist in transactions quickly and efficiently.

SME companies can also raise funds through equity via “SME IPO”. SME IPO Advisory Services have emerged as crucial facilitators, guiding smaller companies through the complexities of the IPO process.

Credwise through its SME IPO Advisory Services cater specifically to the unique needs and challenges faced by Small and Medium Enterprises aiming to go public. These services encompass strategic planning, regulatory compliance, valuation, and investor relations to ensure a successful transition from private to public status.

Schedule An Appointment

Get in contact to get your initial assessment done free of cost.