Main Board IPO Advisory

Our IPO/FPO Advisory Services play a pivotal role in guiding organizations through the intricate process of going public on major stock exchanges. Credwise’s offerings encompass a range of strategic and operational support provided to companies across sectors intending to list on prominent stock exchanges, such as the Bombay Stock Exchange (BSE) or National Stock Exchange (NSE). Credwise’s objective is to assist companies in navigating the complexities of the IPO process, from pre-listing preparations to post-listing compliance.

With in-depth knowledge of the whole equity markets fund raising process including – identification, initiation, structuring, valuation and execution, Credwise team can assist in transactions quickly and efficiently.

Key Components of Credwise’s Main Board IPO Advisory Services:

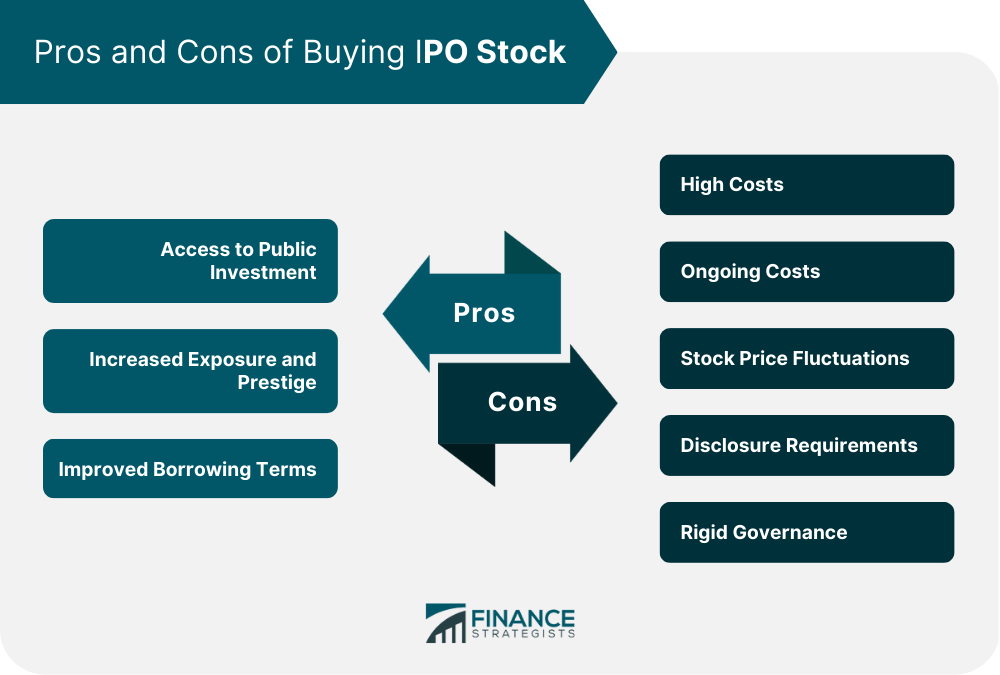

Credwise’s IPO Advisory services begin with a comprehensive assessment of the company's readiness for an IPO. This involves evaluating financial performance, corporate governance practices, and internal controls to identify areas requiring enhancement before going public.

Credwise assists in determining the optimal valuation for the company and developing pricing strategies that align with market conditions. Accurate valuation is crucial for attracting investors and ensuring a successful IPO.

Credwise assists companies to adhere to regulatory requirements set by the relevant stock exchange and securities regulatory bodies. This involves guiding companies through the intricate landscape of disclosure, reporting, and compliance obligations.

Credwise helps companies refine their market positioning and communication strategies. This includes crafting a compelling narrative for potential investors and stakeholders, emphasizing the company's strengths, growth prospects, and competitive advantages.

Credwise team assists in organizing and managing investor roadshows, where company executives present the investment thesis to institutional investors. These roadshows play a crucial role in generating interest and securing commitments from potential shareholders.

Following the IPO, Credwise services extend to post-listing governance and compliance. This includes assisting companies in fulfilling ongoing disclosure requirements, maintaining good corporate governance practices, and navigating the challenges of being a publicly traded entity.

Schedule An Appointment

Get in contact to get your initial assessment done free of cost.