Shadow Rating Advisory

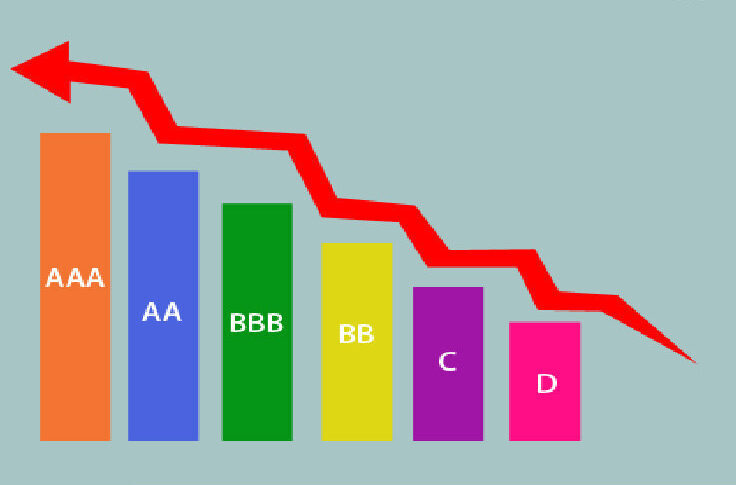

Shadow rating advisory is an emerging facet in the financial landscape that complements traditional credit rating services, offering businesses additional insights into their creditworthiness. Shadow rating advisory involves the evaluation of a company’s creditworthiness outside the formal rating agency framework.

While traditional credit ratings are issued by established agencies, shadow ratings provide an alternative perspective, often incorporating additional factors, industry-specific insights, and nuanced assessments. A shadow rating model is an internal rating approach that selects and weighs the risk drivers to be used for risk differentiation purposes by identifying the main factors that explain external ratings provided by an external credit assessment institution or similar organisation, rather than internal directly observed defaults.

Key Components of Credwise’s Shadow Rating Advisory Services:

Shadow rating advisory services conduct a holistic analysis of a company's financial health, going beyond the scope of traditional credit rating methodologies. This includes considering qualitative aspects such as management quality, industry dynamics, and strategic positioning.

Unlike standardized credit rating models, shadow ratings often include customized factors that are specific to the industry or market conditions in which a company operates. This tailored approach provides a more nuanced evaluation of credit risk.

Many businesses conduct internal shadow rating assessments to gain a deeper understanding of their credit profiles. Credwise is a prominent name in the industry to analyse financial statements, market trends, and other relevant data with regards to any credit risk related assessments.

Shadow rating advisory often incorporates supplemental information that might not be considered by traditional rating agencies. This could include forward-looking indicators, and industry-specific benchmarks.

Our Approach

Understanding client's business and his rating requirements.

Initial analysis and internal team discussion, & closure of the mandate.

Selection of credit rating agency and preparation of broad timelines and schedules.

Organizing information for the rating agency and management discussions.

Analytical discussions with rating agencies & follow-up meetings.

Post discussions communication to client & monitoring of rating assigned to client.

Schedule An Appointment

Get in contact to get your initial assessment done free of cost.